Fasten Your Seatbelts – the Global Economy Is Heading for Turbulence

BY Gerrard Lyons

What is happening to the world economy? An analogy frequently used to describe the global economy is that of a plane and whether it will enjoy a soft landing or suffer a hard one.

Perhaps it may be better to say fasten your seatbelts and brace yourself for turbulence, as the pilots often give the impression of not being sure how to fly, or of what direction they are heading in.

Worries about growth have come to the fore. This is evident in the recent behaviour of markets where bond yields have risen and equity markets have suffered.

It was also seen in the minutes released by the US Federal Reserve last week. They showed a number of policymakers fearful of overtightening monetary policy. Such concerns are even greater here.

At the start of the year, a recession in Western economies was widely expected. This has not materialised. Most, including the UK, have proved resilient. Although lower inflation will boost spending power, the key determining factor for growth will be where interest rates and bond yields settle.

The danger is that businesses find it harder and more expensive to raise funds, because of a credit crunch, tough lending conditions and a more risk-averse environment in capital markets. Elements of this are already evident.

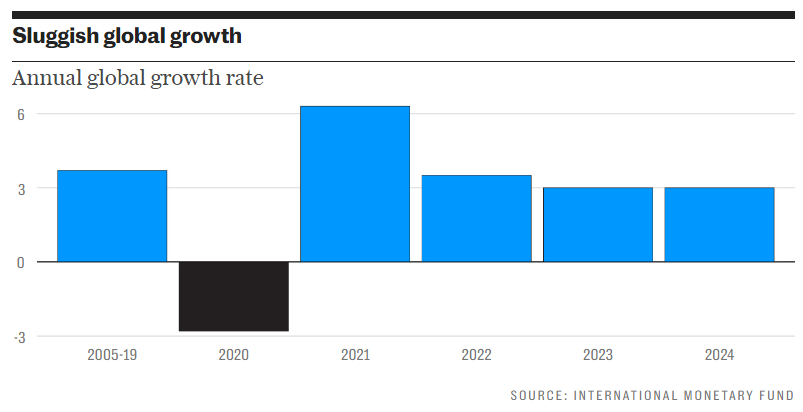

A good barometer of consensus thinking is the economic forecasts from the International Monetary Fund. In late July, they forecast that global growth would slow from 3.5pc last year to 3pc this year and next. This is incredibly weak.

Not only that, but with two thirds of global growth this year expected to come from Asia this explains why there is so much nervousness about recent poor economic news from China.

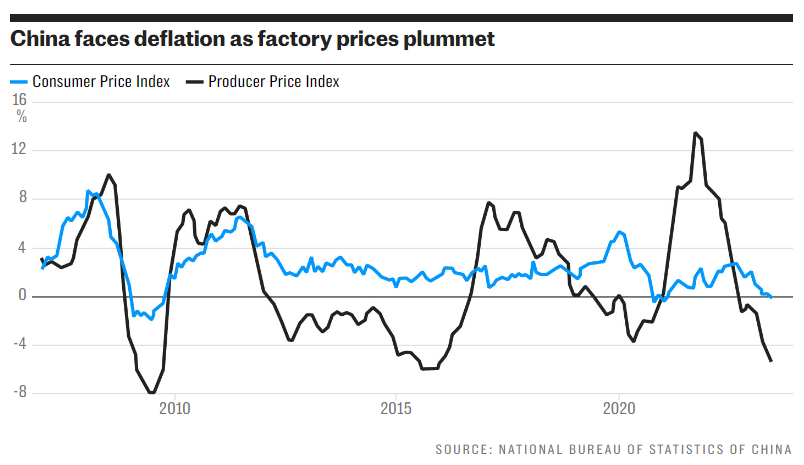

With some prices falling, there is now concern about deflation in China. But low inflation is more likely. Moreover, it is more appropriate to think about a deflationary environment if both prices and output are falling, and China is not in that situation.

In recent years there has been a significant shift to a dual-circulation economic policy in China. Following the trade war with the US under President Trump, China sought to move towards self-sufficiency in areas such as food, fuel and technology. The latest trade sanctions initiated by the US and followed by others do not help.

Such a structural change would have been challenging at the best of times but it has coincided with a more prudent policy environment, both to curb inflation, which China has done successfully, and to constrain the debt overhang, which is proving more of a handful.

Add in the future shrinking population and the net result is that China’s future growth rate will be slower and more erratic than in the past. It is not a time to panic, but to recognise such a structural shift. Moreover, elsewhere across Asia there is evidence of private sector activity holding up well and an economic rebound is underway in Japan, the world’s third-largest economy.

I am positive about the longer-term outlook for global growth. But near-term concerns about growth need to be taken seriously, particularly when the full impact of the normalisation of monetary policy in Western economies has yet to feed through.

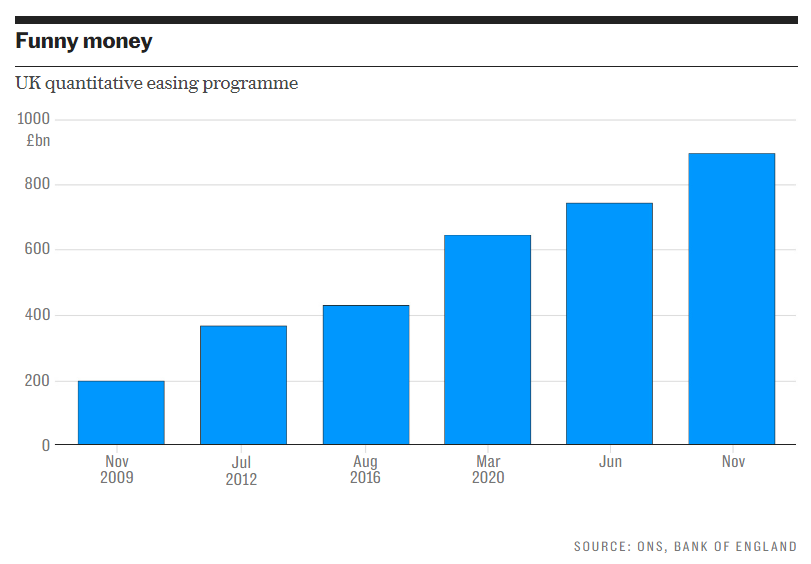

Up until two years ago, Western economies had witnessed a dozen years of cheap money. This consisted of policy rates being kept too low for too long and of central banks printing money as if it was going out of fashion. The balance sheets of central banks soared. Not only was money cheap, it was widely available. Global liquidity was plentiful.

Cheap money led to asset price inflation, allowed markets to not price properly for risk, led to a misallocation of capital including the survival of zombie firms and it also helped feed the recent surge in inflation.

Those countries that adopted a prudent approach to monetary policy are in a far better position to act now. These were largely in the so-called emerging economies. For instance, in recent weeks, Chile and Brazil have been able to cut interest rates. They had sensibly tightened policy before the recent surge in inflation and so are now able to ease policy to head off economic weakness.

China, too, cut interest rates last week, and while that action was in response to a slowing economy, its ability to ease was because of its previous prudence.

Currently there is a valid concern about policy rates in the US, UK and euro area rising too far. Even when rates peak, central banks will still be tightening policy by shrinking their balance sheets through quantitative tightening. This doesn’t augur well for growth.

While I wouldn’t tighten further, there is also the need to avoid a return to cheap money. So in future policy rates may have to settle at a high level.

How markets will cope with this is unclear. It has already prompted the question of what constitutes a risk-free asset? Government bonds were seen as this. During the pandemic, a third of government bonds globally traded with negative yields, meaning that investors saw these as truly safe. Effectively, governments were being rewarded for borrowing.

Now, over the last three years because of inflation, rising policy rates and tighter global liquidity, government bonds have witnessed negative total returns. If you had bought this safe-haven, you would have lost money.

Since the 2008 global financial crisis there has been a shift in financial markets, with the rise of shadow banking. The latest report from the Financial Stability Board on the scale of this shows that at the end of 2021, total financial assets had risen to $485 trillion. Yes, trillion. And the amount provided by non-bank financial institutions had reached almost half of this, $239 trillion.

Collateral, often in the form of government bonds and other quality debt, plays an important part in underpinning this system. If this is now being questioned as a safe asset it suggests not only greater financial instability but also greater risk aversion, meaning that global liquidity conditions will naturally tighten further. Stabilising policy rates and yields may thus become vitally important.

So the focus is shifting from inflation to growth. Next, I expect the focus of financial markets to shift to debt. Public and private debt levels globally are high, limiting the room for policy manoeuvre and leaving many people and firms exposed to a sustained period of high interest rates. Keep the seatbelts tightened.

###